LockIt® Card Controls

Control how and when your card is used.

4 ways to block card transactions with LockIt

Block all transactions

Your card cannot be used for:

- Any purchases (online, in-store and other)

- Call Center transfers

- ATM cash withdrawals

- ATM transfers to deposit accounts

- Non-recurring transactions

- Credit card cash advances from an ATM, Regions branch or another Visa® bank

Block ATM transactions

Your card cannot be used for cash withdrawals, ATM transfers to deposit accounts, or credit card cash advances at an ATM, Regions branch or other Visa® bank.

Block in-store purchases

Your card cannot be used for in-store purchases when the transaction is processed through a merchant terminal at the store. This does not block in-store pickup purchases made online or through a mobile app or site.

Block online purchases

Your card cannot be used for purchases online, by mail order or by phone. This does not block purchases made through a mobile app or site.

LockIt controls will not block:

- Transactions processed when standard authorization systems are not used.

- Merchant-identified recurring transactions, credits to your account, ATM deposits, ATM Now Card loads, ATM payments (including transfers from your deposit accounts to your credit accounts), ATM check cashing, ATM inquiries or ATM account mini-statements.

- Overdraft protection advances if your credit card provides overdraft protection to your checking account.

Using LockIt is easy

Select the controls from your Regions Mobile App or through Online Banking to block the types of transactions that are right for your situation. With LockIt controls at your fingertips, you’ll save time and enjoy increased peace of mind and convenience.

Other card-control features

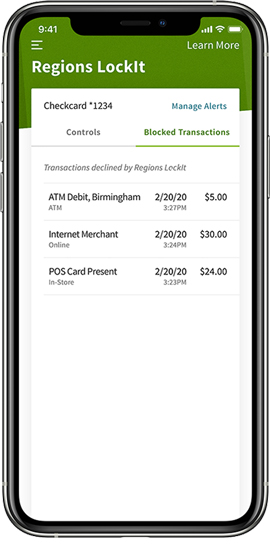

Monitor blocked transactions

In the Blocked Transactions tab, you can review the history of transactions that were blocked due to a control you activated through your mobile banking app or in Regions Online Banking.

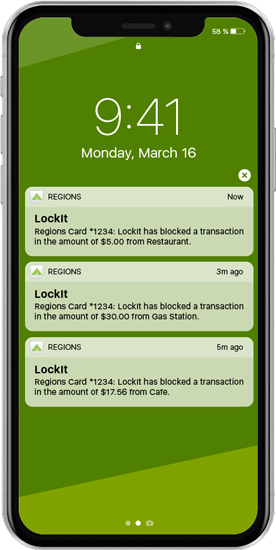

Receive alerts

Get alerts about blocked transactions the way you want. You can:

Set up LockIt alerts through Online Banking or the Regions Mobile app.

Choose the contact method you prefer, such as push, text or email.

Whether you use LockIt in Online Banking or through the mobile banking app, we may notify you by mail each time we block a transaction.

LockIt FAQs

-

No enrollment is necessary. Regions LockIt is available through the Regions Mobile Banking App and in Online Banking on all personal credit cards, debit cards, prepaid Now Cards and ATM cards. LockIt is not currently available on business cards.

-

Using Regions LockIt card controls helps you control how and when your cards are used. Select the level of control required to block the transactions you need for your particular situation — for example, if you suspect fraud, misplace your card or just want to manage how and where a card is used.

-

In the Regions Mobile app, there are two ways to access LockIt:

- From the main menu, select Cards. Choose the card you want to manage and select LockIt Card Controls.

- Or select an account and tap the Card icon.

- You can set up and manage preferences for Regions LockIt Alerts in the app by selecting Alerts from the main menu. Choose the contact method you prefer, such as push, text or email, to get notifications about declined transactions delivered right to your mobile device.

-

To access LockIt through Regions Online Banking:

- Log in and select Manage Regions LockIt from the I Want To dropdown menu on the top right corner of your dashboard.

- Or you can also access LockIt controls by selecting the Customer Service tab and then Regions LockIt under Card Services.

-

You can use Regions LockIt on both your mobile app and in Online Banking to activate or deactivate card controls, regardless of which method you use to activate or deactivate a control:

- It’s effective immediately and will be reflected on both the mobile app and in Online Banking.

- Any blocked transactions are listed on the Blocked Transactions tab on both the mobile app and in Online Banking.

We may send you an email each time we block a transaction. There is no setup necessary.

-

No. Pre-authorized recurring transactions cannot be blocked using LockIt. If you want to cancel a recurring transaction, you should call the merchant to revoke your authorization.

Blocking All Transactions also will not block credits to your account, ATM deposits, ATM Now Card loads, ATM payments (including transfers from your deposit accounts to your credit accounts), ATM check cashing, ATM inquiries or ATM account mini statements.

If your card provides overdraft protection to your checking account, it will not block overdraft protection advances.

-

“Standard authorization systems” refers to the network systems that are used to obtain actual authorization from issuers for card transactions. If a card transaction is not processed through these systems, LockIt won’t block it. Some instances where LockIt would not block card transactions include:

- When these systems are down, and transactions are processed through alternative authorization solutions.

- When a merchant chooses not to get authorization.

-

You can still use your card at an ATM to:

- Make a deposit to your checking account

- Load funds to your Now Card

- Cash checks

- Make payments (including transfers from your deposit accounts to your credit accounts)

- Check account balances

- View/print account mini statements

But you will not be able to withdraw funds, transfer funds or get a cash advance with a credit card.

-

As soon as you activate or deactivate a LockIt control, all new transactions covered by that control will be immediately blocked/unblocked.

-

You can log in to Regions Online Banking to manage LockIt controls or call us at 1-800-REGIONS (1-800-734-4667) for assistance.