My GreenInsights

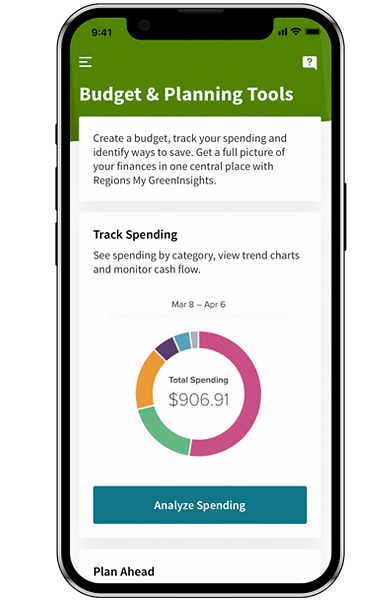

Budget & Planning Tools

Get a clear picture of your finances with My GreenInsights.

We make it easy to manage your money at home or on the go.

Manage all of your finances in one place

Regions My GreenInsights is designed to help you take control of your finances and build your savings.

- Activate easily in one step

- Link and sync accounts for the best experience

- Customize your view, categories and tags

- Set up a budget to track spending

- Discover expenses to cut, like duplicate subscriptions

- Add savings or loan payoff goals

- Monitor cash flow

See how it works

We make it easy to manage your finances in one view. Add your accounts, including those at other financial institutions,[1] to analyze spending. Then create a budget and set up savings goals.

Get started

It takes just two simple steps to get started:

- Log in to Online Banking. Select the Insights tab.

- In the app, tap in to Budget & Planning Tools. Select Get Started to sync your account information.

When you enroll, we will sync the last 90 days of account activity. It will be automatically categorized to help you get started. Don't have the app? Download it today:

How to get the most from these tools

Watch our video tutorials that show how to use My GreenInsights in Online Banking. Customize which accounts you pull into your dashboard, how transactions are tracked and set up goals or budgets.

Customize your view

Connect all accounts. View a combined list of your recent transactions. Rename, tag and add memos so you can find transactions easily in the future.

Track your spending

How much did you spend on groceries last month? The spending tool automatically shows where your money is going by breaking activity into categories.

Create a budget

Create a budget, set spending targets and goals, identify ways to save and more. The tool displays a quick view of the areas that need the most attention. And, get notified before overspending.

Frequently Asked Questions

-

In the mobile app: Access Budget & Planning Tools in the main menu. Tap Get Started to sync Regions account data and transactions. You can then link external accounts, customize your experience, set up budgets and more.

In Online Banking: When viewing your account, look for the Insights tab to access My GreenInsights budgeting tools. Watch our video on how to get started (view transcript). You can then easily create a budget, set spending targets, identify ways to save and more.

-

We provide extensive instructions for features such as linking external accounts, how to customize your experience, set up budgets and more. You will find a Help section within the My GreenInsights tool.

- In the mobile app: Access Budget & Planning Tools in the main menu. Navigate to the bottom of the page to access the Help & FAQs area.

- In Online Banking: When viewing My GreenInsights budgeting tools, look for the question mark icon. This will direct you to the Help section with many topics and instructions. For a general overview, watch our video on how to get started (view transcript).

-

The Cash Flow and Cash Events feature combs through your transactions to help you understand historical spending and predict future spending. It allows you to easily identify and add recurring bills and payments, as well as one-time or annual payments such as property tax. It helps you see the impact of upcoming payments and plan ahead.

Data Visualization

For convenient data visualization, we provide several options: a Chart (over time), a Calendar (monthly view), and a linear view of Cash Events.

- In Online Banking: For the best viewing and interactive experience, access the tabs for Cash Flow chart and Cash Flow calendar.

- In the mobile app: For the best viewing experience on a mobile device screen, we provide a linear view of Cash Events in the the Track Spending area. To see a calendar or flow chart, log in to Online Banking or access your account using a web browser. Note: You may add or edit Cash Events that appear as one-time or recurring income or expenses. Any edits you make in the mobile app will also appear in Online Banking.

-

To get a well-rounded view of your finances, it's important to aggregate multiple accounts to see spending, savings, loans and investment account information. Easily add external accounts by:

- In the mobile app: Access Budget & Planning Tools in the main menu. Navigate to section for Manage Linked Accounts.

- In Online Banking: Access the Insights tab to view My GreenInsights budget and planning tools. In the top right corner of the My GreenInsights screen, select the green +Add an Account button. A new screen will appear. Select the Continue button and choose from the list provided or manually add a financial institution.

While accounts information is available from thousands of online financial institution websites, some financial institution accounts may not be compatible. Account information data displayed is for information purpose only and represents the balances or holdings in the account(s) when data was last collected. The displayed balance or market value for some of the accounts may not be accurate, as some financial institutions may not allow aggregators to access real-time balances during business day or market hours. Your account statements are the official record of your balances and holdings.

Need more help with My GreenInsights?

Browse through the most commonly asked questions in our FAQs. For more assistance with My GreenInsights, contact us at 1-800-472-2265. My GreenInsights service is available to all Regions account holders who are eligible for Online Banking. If you don't have an account with us, open an account today. If you are not already an Online Banking customer, enroll now.[2]