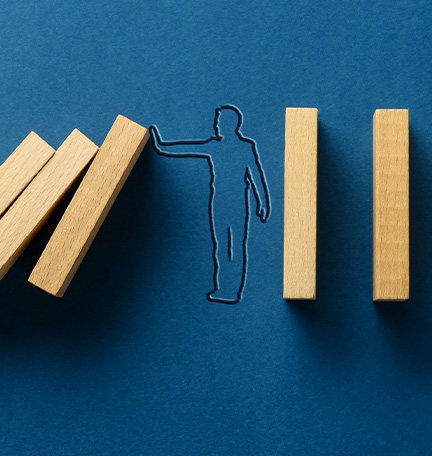

Protect your company against unseen risk by developing leading indicators to flag looming issues.

A robust risk management program not only highlights risks that an organization faces, but can also reduce their impact or help avert them altogether. This is only possible if one is able to peer into the future to see what risks and opportunities may be on the horizon. But how? Key risk indicators (KRIs) are metrics that your company can use to help anticipate trends that may indicate future risk. Here’s what you need to understand in order to develop a suite of actionable KRIs for your company:

- KRIs are forward-looking. The most important thing to understand about KRIs is that they are leading indicators of potential risk, says Chad Webb, executive vice president, head of enterprise and operational risk at Regions Bank. This is in contrast to Key Performance Indicators (KPIs), which are designed to measure how well something has been done in the past. “KPIs are generally historical in nature, (i.e., how we performed last quarter), and while they may be useful for assessing risk, are not specifically designed to be leading indicators of risk,” he notes.

- KRIs are based on strategy. “To develop the most effective key risk indicators, you first need to understand the strategic goals and objectives of the company,” Webb asserts. “You also must have an understanding of the top risks affecting the company’s ability to achieve those goals and objectives. An understanding of historical performance trends is also critical in establishing effective KRIs.” Let’s say, for example, that ease of use is an important market differentiator for your company’s products. One potential KRI could be customer-service volume. An uptick in calls, particularly if it exceeds a pre-established threshold, could indicate a looming problem.

- KRIs are measurable. One advantage of KRIs is that they take emotion out of the equation. By establishing quantitative metrics and setting thresholds for action, senior managers can respond to risks appropriately as they arise, rather than over- or under-reacting based on gut feelings. This also means that KRIs should be based on readily available data. “On the outset of developing a KRI program, a company should consider internal and external data availability and limitations, staffing implications, and system requirements necessary to keep track of oftentimes voluminous data,” Webb says. “Management should review the metrics currently being used to monitor risk and performance as well as the policy limits that would trigger corrective action.”

- KRIs are actionable. Finally, it is crucial that your company has an action plan in place should a KRI reach or exceed established tolerances. This has the additional benefit of empowering managers and employees to recognize and mitigate risk. “KRIs are central to promoting a sense of ownership and awareness of risk within an organization,” Webb says, adding that identifying new and emerging risks, reporting to senior management and the board of directors, and improving overall performance are just a few key roles that KRIs play in managing risk throughout the organization.

Do you know what the future holds for your company? While you can’t predict exactly what looms around the corner, a solid KRI program can give you insight into likely events so that you can reduce risk and take advantage of unexpected opportunities.