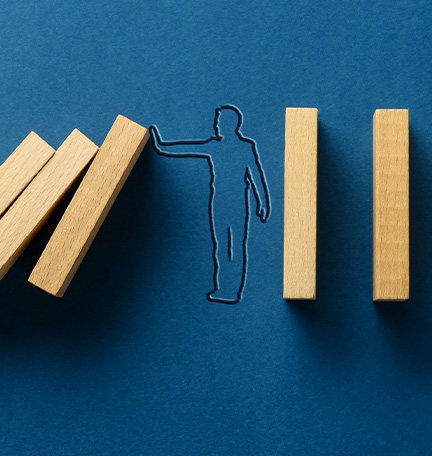

Your employees should be your first line of defense against fraud.

For businesses, it’s difficult to avoid the losses associated with fraud. In fact, 71% of the organizations surveyed by the Association for Financial Professionals report experiencing payment-related fraud incidents.

“Creating a company culture where payment fraud can’t thrive is so critical,” says Jeff Taylor, Head of Commercial Fraud Forensics and Payment Strategy at Regions Bank. “Building an environment where everyone owns fraud will foster this culture.”

An anti-fraud culture should emphasize awareness and due diligence by all employees. To reduce payment fraud, your efforts will need to specifically target employees involved with the money-related areas of the business, such as those working in finance, treasury, or accounts payable and receivable roles.

Heightened awareness is critically important here because most payment fraud happens as the result of complacency, says Taylor. “Like driving a car, we get so used to doing things automatically that we sometimes don’t pay full attention to what we’re doing.”

To support a culture of awareness, Taylor suggests that managers train employees to pause, question, and verify new information before completing transactions. Creating a payment process checklist can help ensure a consistent, comprehensive verification process. “If you see a change, it should be a red flag to wait a minute and verify that the supplier really has sent it,” he cautions. “Add some ‘pause points’ in your process for verification, especially above a certain dollar threshold.”

Likewise, consider building more time into your company’s payment process. “Fraudsters use urgency and time constraints to force payment control shortcuts,” Taylor explains.

Commit To Ongoing Fraud Training

All employees at your organization — particularly those who are connected to money and money movement — should go through periodic training. Taylor recommends a regular program of fraud training supplemented by ongoing communications as needed throughout the year. “Fraud training is your best protection. It’s critically important to be aware of the latest developments and to keep talking to employees about how the risk of fraud can impact them,” he says.

The people in your firm who manage compliance and risk are the right choice to tackle updating your company’s payment fraud training and communications strategy. While smaller organizations may not have the budget to invest in external training, they can still effectively train their employees to spot and prevent fraud.

We’ve created the following video as a resource that employers can share with their employees to help create awareness:

Finally, as cases of payment fraud and business email compromise continue to rise, it’s important to implement internal controls. Learn more about how to safeguard your business from payment fraud.

For additional fraud prevention resources and insights, visit regions.com/fraudprevention.