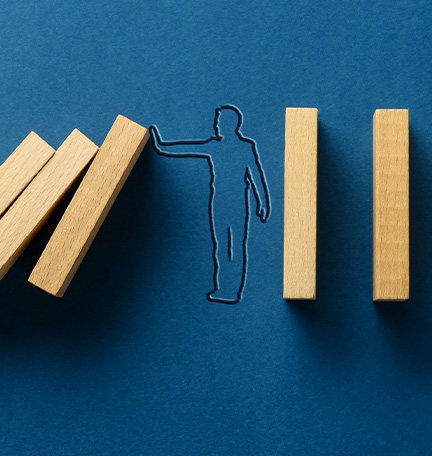

Today’s continuity plans must be flexible, adaptive and forward-thinking.

As every business leader knows, we live in a time of disruptions. While businesses have always had to contend with uncertainties, today’s climate makes it even more essential for organizations to develop business continuity plans that can cover a wide range of potential events. Cybercrime and supply chain issues can disrupt operations. Market factors, such as inflation and interest rate adjustments, can impact sales and profit margins. Regulations and policy shifts can create new headaches and hurdles.

“Disruptions occur all the time, and for businesses to be relevant in today’s environment they must begin to anticipate different, sometimes unexpected, changes that may impact their business,” says Christian White, Commercial Banking Leader for South Alabama and the Florida Panhandle at Regions Bank.

Even if you already have a continuity plan in place, one of the biggest challenges businesses face is to make sure that plan is adaptive and can withstand today and tomorrow’s disruptions. Here are four steps to ensure your continuity plan can withstand a multitude of risks.

Step 1: Evaluate Your Continuity Plan

According to White, businesses should work with their bank to review and strengthen their continuity plan regularly—ideally on an annual basis. Their commercial banker can help identify gaps in the plan and offer solutions or ideas on how to make relevant updates.

The evaluation process is especially important in light of a business’s need for data protection. While all aspects of a business merit a critical eye, businesses are increasingly reliant on their data, and IT disruptions such as outages and brownouts can have grave consequences, potentially costing a business millions of dollars.

Likewise, for companies with very specific concerns—such as accessing capital or paying vendors and employees during a crisis—a commercial banker can work with you to identify potential solutions.

“We can address gaps that we may see from a technology standpoint or a risk standpoint, and we can talk to our customers about ways to mitigate those risks,” White says.

Step 2: Think Globally—and Locally

While some disruptions occur on a global scale, affecting businesses across the board, individual organizations must also consider all the potential local factors that can impact operations, personnel, customer demand and more.

These days, those factors may include regional economic trends, overseas competition, legislative or policy issues, access to qualified employees and climate risks.

By leveraging local teams that have deep industry and area knowledge, Regions’ commercial bankers take the time to get to know your business and its needs, as well as any particular threats you may have to plan for.

“The local team is able to use all the things that they know about the customer and all the things they know about the industry to create a continuity plan that is fit specifically for that customer,” White explains. “It really goes back to the relationship that we have, the knowledge of the business and the knowledge of the industry that allows us to put together a good and solid plan.”

Step 3: Future-Proof Your Plan

The hard part about business disruption is that you never know what could come next. That’s why it’s good to have a broad plan that is versatile enough to address any kind of disruption.

That may sound like a tall order, but this is the task facing today’s business leaders. A ready-for-anything continuity plan requires not merely thinking ahead but tapping into industry resources that are focused on anticipating trends—and identifying likely challenges.

“We always say it’s better to recover from a disaster by implementing new components to an existing plan rather than having to create one in the midst of a disaster,” White says.

Step 4: Communicate the Plan as It Evolves

It’s not only business leaders who live in a climate of uncertainty—so do executives and staff. To boost morale—and help reinforce the efficacy of your business continuity plan—be sure to have a robust communication strategy once the procedures are in place.

This will help ensure that the plan or plans are comprehensive and reflect internal structures and priorities. Management and team leaders can help establish checklists to support systems and protocols, as well as ways to access sources for essential supplies and materials should they become compromised or unavailable.

While no one has a crystal ball, and there’s no way to 100% predict the threats that may lurk beyond the horizon, these four steps will enhance your current continuity plan so that your business is in a stronger position, no matter what unfolds.

Three Things to Do

- Listen to this podcast on how to plan for the unknowns.

- Speak with a commercial banker to determine whether a capital solution could help you to mitigate risk.

- Read about how to uncover supply chain vulnerabilities.