10 Things to Know About Homeowners Insurance Before Closing

Don’t wait until a claim is filed to find out you’re underinsured.

With so much to do during the homebuying process, it’s easy for homebuyers to overlook making sure their home and belongings are sufficiently insured. Unfortunately, some might only discover this when they need to submit a claim after a major loss.

“Home insurance is one of those things that you only really appreciate when you need to file a claim, and you hope you’ll never have to,” says Cynthia Valenti Smith, Mortgage Production Manager at Regions Bank in Naples, Florida.

Home insurance is mandatory if you’re borrowing to pay for your house because the home lender must protect its financial stake. Here are 10 things to know about buying a policy before you close on your new home purchase.

-

Begin the Process ASAP

Start shopping for home insurance as soon as you apply for a mortgage. It takes time to get insurance quotes and evaluate them. There also are many potential issues that could come up, and some could be deal breakers.

“We don’t know whether the home is in a flood zone, and we won’t necessarily know until we complete a flood certificate at the start of the application process,” says Smith. “If the home has had a claim, the cost of insurance might be higher. Even though the home may be a very good value for the purchaser, the insurance coverage might make it unaffordable if it makes their debt-to-income ratio too high.”

-

Educate Yourself

Many first-time homebuyers might simply want to check off “buy insurance” from a to-do-list. But it’s important to understand why you need insurance and what your policy does and does not cover. For example, most standard policies don’t cover floods or earthquakes. Having such knowledge can help you avoid a nasty surprise if you need to file a claim one day.

-

Look Beyond Price

Your goal is to make sure all your belongings are covered. Work with an insurance agent whom you trust. “Don’t just look for the lowest premium,” says Smith. “Compare the value of each policy. Understand why they are different. By shopping around, you could possibly find better coverage at a lower price.”

-

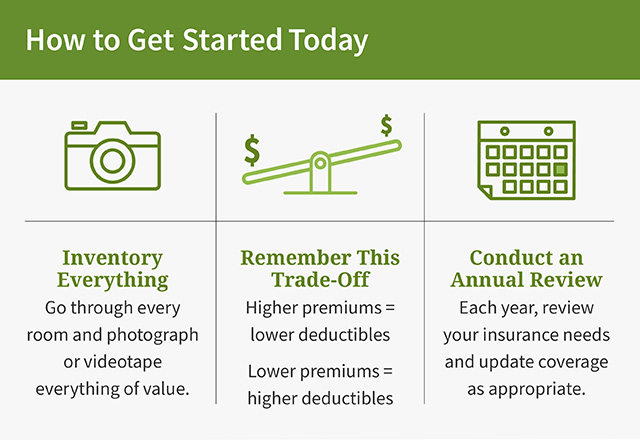

Do a Full Inventory

“People tend to not fully appreciate the true value of their personal belongings,” says Smith. “If asked what they would need to replace everything in their home, they’ll throw out a number. But how can they know if they never took an inventory of everything in their home?”

One way to do a home inventory is to walk through your home with a video camera or cellphone. Provide descriptions through narration and pay close attention to the high-value items. Taking photos of serial numbers can be a worthwhile exercise. Go from room to room and take your time. Include electronics, furniture and personal belongings of all kinds. Don’t forget about your power tools and equipment in your garage or storage shed.

-

Be Thorough

Make sure your insurance covers any and all extras. For example, you might need additional coverage for expensive items such as artwork, jewelry, musical instruments and collectibles.

Don’t forget about the additional liability that comes with owning a pet. The presence of a dog is an important consideration for an insurance company, as the policy’s liability insurance should cover dog bites or any other mishap such as if your dog were to jump on a guest and that person were to fall.

-

Cover the Replacement Cost

Don’t focus on the current (depreciated) value of an item you bought a decade ago. What really matters is how much it would cost to replace that and everything else you own today, in the event of a fire, hurricane or other covered disaster.

-

Consider the Size of Your Deductible

There is no one right answer when it comes to choosing a deductible on a home insurance policy. It’s a trade-off.

- A lower premium typically comes with a higher deductible, in which case you’d be accepting a higher degree of risk should you incur a loss.

- A higher premium would tend to provide more thorough coverage by lowering your deductible.

The key is to make a thoughtful, informed decision based on your budget and how comfortable you might be in one scenario or the other.

-

Don’t Self-Insure

Self-insuring, or going without home insurance, is highly risky and typically not recommended. This applies to people who don’t have a mortgage and are not obligated to have home insurance coverage, such as someone who is buying a house with cash.

The problem with going without insurance is that if anything catastrophic were to happen, you could be financially devastated. Consider losing your home and all its contents in a fire. What would you do? Wouldn’t it be more prudent to protect against that risk?

-

Don’t Over-Insure

The flip side of having too little or no insurance is wasting your money on insurance coverage that you don’t need. Let’s say your home is valued at $1 million. That figure includes the value of the land that your home sits on. In the event of a total loss, it is just the value of the home itself and its contents that would be replaced, not the land it sits on.

-

Plan an Annual Review

Just as you should conduct a review of your investment portfolio and your entire personal financial situation at least annually, also conduct an annual home insurance review. Consider it part of a regular financial wellness check-up. Work with your insurance agent. Consider what, if anything, has changed pertaining to insurable belongings.

Also consider doing this whenever a major change occurs that would affect your insurance needs. For example, you’d need more comprehensive coverage in the event of getting a dog or inheriting artwork or jewelry. Update your insurance coverage promptly, so you know you’re adequately covered before you ever need to make a claim.

Three Things to Do

- Review our checklist on disaster preparedness for any homeowner.

- Read more about buying a home during an up or down housing market.

- Listen to our podcast on buying homeowners insurance for your new home or reevaluating your existing policy.