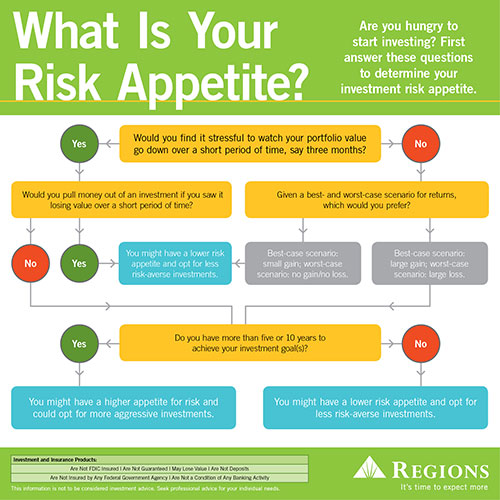

When you start to invest in any market, your first step should be determining your risk appetite — or how much investment risk you can handle. You might be comfortable navigating the market’s high peaks and low valleys. Or you might find the uncertainty that can come with an aggressive investment strategy too stressful. These three questions will help you determine your appetite for risk.

1. How Much Investment Risk Can I Stomach?

If you want to achieve a certain amount of financial growth, you need to have some financial and emotional tolerance for risk, says Mark Gartman, Financial Advisor with Regions Investment Solutions. That’s because if you find it too stressful to watch your portfolio value go up and down, you might act impulsively.

“Pulling your money out at the slightest market fluctuation may not be a good idea. You can end up losing money over the long run,” Gartman says. If you have little to no comfort with market fluctuations, you might want to consider building a portfolio with less investment risk.

2. What Is My Investment Goal?

People often come to a financial advisor to handle one aspect of their finances, like setting up a 529 college savings plan. But a good financial strategy looks at the bigger picture. “I look at my client’s aspirations, risk concerns, and assets. I ask them, ‘What are you trying to accomplish?’” says Gartman.

Most people are trying to reach multiple financial objectives. “If my clients have a young child, they might have retirement goals and want to buy a lake house in the not-too-distant future. So I help them designate funds for each of these,” Gartman says.

He recommends maintaining a diversified portfolio to work toward financial goals while also mitigating risk. “I spread my clients’ assets across investment vehicles,” he says. “The objective is to create balance so that all assets are not in any one category. It’s the ‘don't put all your eggs in one basket’ concept.”

3. What Is My Investment Timeframe?

Your risk appetite can rise and fall along your investment timeline, which measures both your age and how much time you have to reach your financial goal.

For example, as you near retirement, your risk tolerance will likely decrease because you have less time to recover any money lost as a result of market fluctuations, Gartman says. But when you’re planning for retirement 30 or 40 years out, you may be able to tolerate a higher level of investment risk.

Gartman suggests setting aside at least 10 percent of your net income per paycheck when you’re in your 20s for long-term goals like retirement. “This should not only help you achieve your longer-term goals, but it should also help you stay out of debt and accumulate wealth over time,” he says.

Learn more about understanding your risk appetite — and saving for the future — by visiting the Regions Investment Management Center.

Mark Gartman is a Financial Advisor with Regions Investment Solutions. Regions Investment Solutions is a marketing name of Cetera Investment Services. Securities and insurance products are offered through, and Financial Advisors are registered with, Cetera Investment Services LLC, member FINRA/SIPC. Advisory services are offered through Cetera Investment Adviser LLC. Neither Cetera investment Services nor Cetera Investment Advisers is an affiliate of Regions Bank or its related companies.

Regions Investment Solutions, 250 Riverchase Parkway East, Hoover, AL 35244. Regions Investment Solutions is a marketing name of Cetera Investment Services. Securities and insurance products are offered through Cetera Investment Services LLC, member FINRA/SIPC. Advisory Services are offered through Cetera Investment Advisers LLC. Neither Cetera Investment Services, nor Cetera Investment Advisers is an affiliate of Regions Bank.