Your credit score is a major factor in your ability to get a loan and how much interest you pay. A good credit score could save you thousands of dollars over the course of a mortgage, for instance. Understanding how your credit score is calculated can help you keep your score in a good spot.

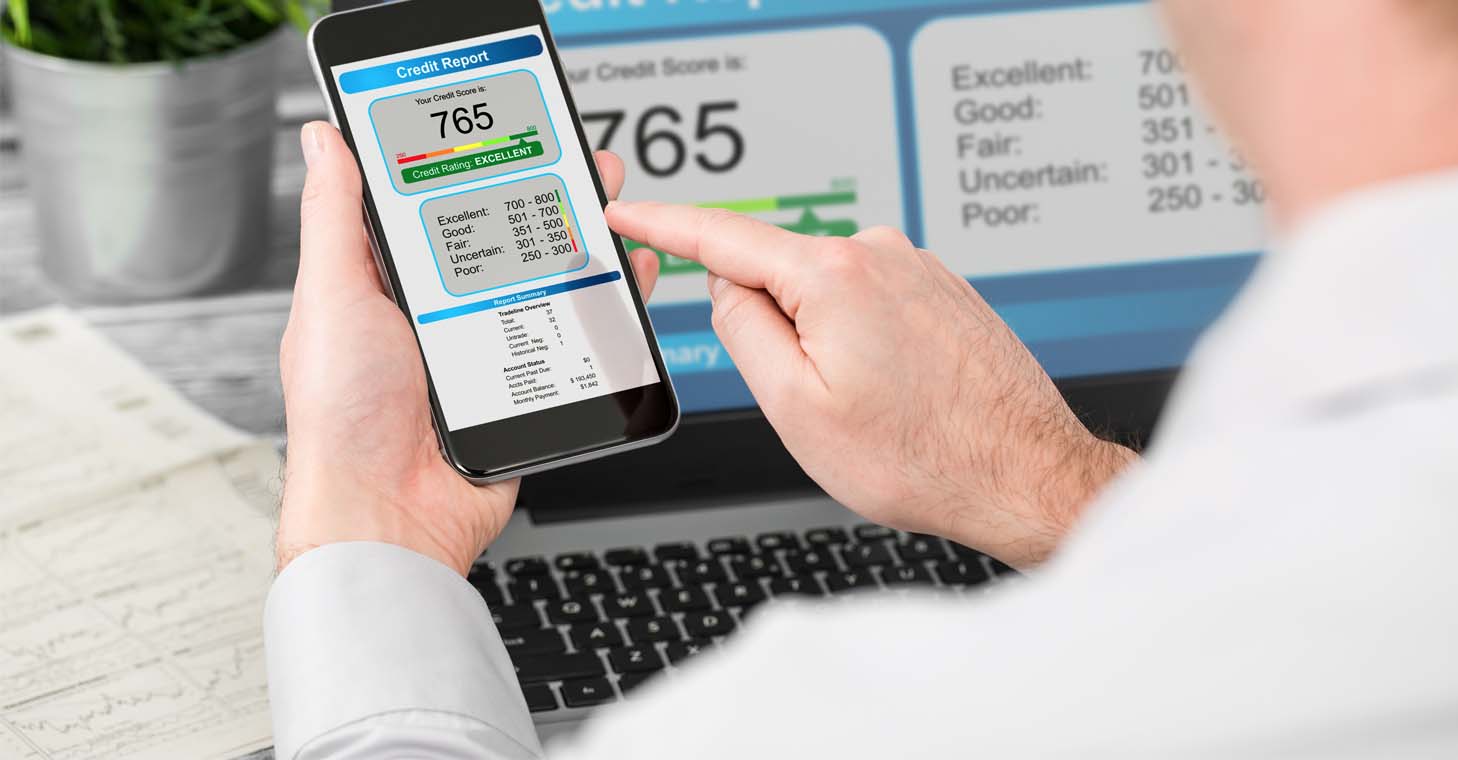

Most lenders report information about their accounts with consumers to three major credit bureaus: Experian, TransUnion, and Equifax. The information reported to a bureau is included in the consumer's credit report with that bureau. The credit report may include a credit score, which is a three-digit number summarizing an individual's credit risk. A consumer's credit score is based on the consumer's full credit report at the bureau and is calculated using proprietary models developed by private companies such as the Fair Isaac Corporation (FICO®). Every day, thousands of lenders, landlords, and employers use credit scores to make credit, housing, and employment decisions. Although none of the bureaus share the exact formulas for each of their credit score models, FICO's website indicates these are the main five categories of information they consider and the approximate weight of each. For more information about FICO and its credit scores, visit myfico.com.

You can check your credit records from each of the three credit bureaus for free annually. To order your free credit report call (877) 322-8228 or visit annualcreditreport.com.