Has a stranger ‘accidentally’ sent you money on a payment app? Beware — it might be a payment app scam.

As peer-to-peer payment apps have grown in popularity, scammers have devised new payment scams to take advantage of unsuspecting users.

If you’ve received money from someone you don’t know on Cash App, Venmo, Zelle®, or another payment app, you may have assumed it was sent by accident — after all, mistyping a friend’s username or email address is easy to do. However, this “mistake” may actually be an attempt to scam you out of your hard-earned money.

Here’s how this payment app scam works:

- A fraudster creates a profile on a peer-to-peer payment app and links a stolen credit card number to the account. The attacker uses the app to send payments to other users.

- The scammer then messages the recipient(s) through the app, claiming the payment was sent by mistake and begging the recipient to pay the funds back.

- The sender then replaces the stolen card on the app with a personal card, to which the recipient’s payment is applied.

- Later, the owner of the stolen card may dispute the fraudulent payment, causing the funds to be pulled from the recipient’s account. In that case, the recipient becomes the victim, having already “returned” the funds to the attacker.

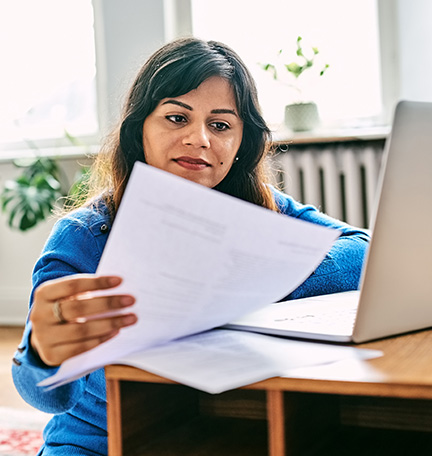

Here’s what to do if someone “accidentally” sends you money on a payment app:

- Do not follow return payment instructions from a stranger.

- Ask the sender to cancel the transaction immediately — in many cases, the sender can simply contact the app’s customer support to cancel the transaction.

- If the sender refuses to do so, contact the app’s customer support yourself, explain the situation, and ask them to reverse the transaction.

Protecting Your Money

As scammers adapt to new payment technologies, a few tips may help you be less susceptible. For example, while it may be tempting to participate in social media promotions that require you to post your personal payment app username (such as your $Cashtag) online, doing so can make it easier for scammers to target you.

Likewise, before adding your payment information to an app, be sure to do your research. According to Better Business Bureau data, some payment apps appear to be less vulnerable to fraud than others. For example, fraudsters will likely avoid apps that have robust identity verification processes in place.

When using payment apps, a little bit of caution can go a long way. The Better Business Bureau offers these tips:

- Consider linking a credit card to your payment app accounts, rather than a debit card. You can dispute charges to your credit card without tying up your personal funds, whereas payments sent via debit card will have been automatically deducted from your account.

- Enable additional security settings within the payment app, such as multifactor authentication, a PIN, or fingerprint recognition.

- Above all, use money transfer apps only with people you know personally. Always double check your friend or family member’s username or email address before transferring funds and confirm that the payment was received.

If you suspect that you’ve been targeted by a scammer on a money transfer app, report it to reportfraud.ftc.gov. For more tips on how to protect yourself and your wallet against common scams, visit regions.com/fraudprevention.