Tips for broaching a delicate topic.

It can be one of the most difficult conversations you ever have with your parents. As they get older, it may also be one of the most important.

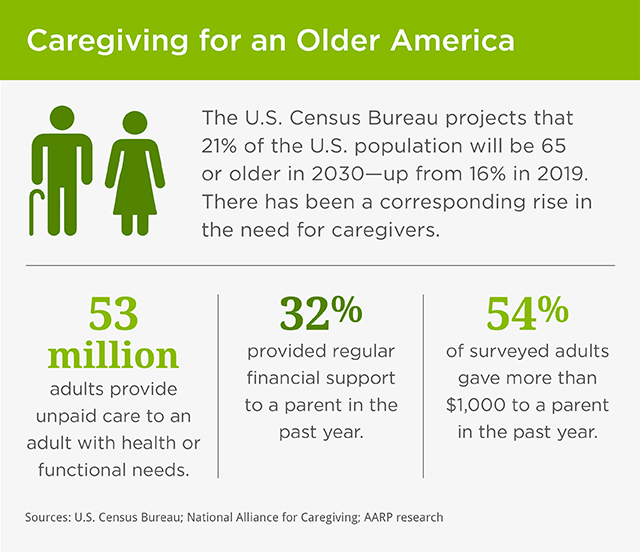

Many adult children will face a time when one or both of their parents, because of age or illness, are no longer able to manage their finances or handle estate planning on their own. But acknowledging the need for help is hard for many older people, especially those who are used to caring for (and not being cared for by) their children.

You may be tempted to simply ask “Where are your accounts?” or “How much money do you have?” or other straightforward questions. “These questions can come across as intrusive, even from adult children who are financially responsible and successful,” says Destinee Sanders, a Private Wealth Advisor with Regions Bank in Birmingham, Alabama. “Approaching the conversation this way can bring up insecurities for parents around autonomy, which most fear losing during this time in their life.”

Children who avoid the discussion are likely to face serious problems if and when their parents become incapacitated or after one or both passes away. To avoid a negative outcome—and an uncomfortable shutting down of the conversation—it pays to adopt a measured strategy for talking to your parents. Here are some practical guidelines to follow.

1. Start Slowly, Start Early

While the right time to broach the topic of your parents’ estate is different for everyone, a good idea is beginning while your parents are still independent and able to manage their finances. The more assets your parents have, the more complicated it could get if you wait until they are no longer on top of everything.

Breaking the ice can be tough, though, so Sanders recommends starting with a relatable story. “You can tell them a friend went through some issues with their relative and that you’d really like to avoid that. It’s a less intrusive conversation starter than what you might inherit one day.”

2. Ask About the Essentials, Not the Money

Build trust from the outset. Until you and your parents have reached an understanding about your role, steer clear of the details about their financial accounts and assets. “There is a subset of parents who just aren’t comfortable with their children knowing everything—or anything—about their finances,” says Sanders.

Instead, start by asking about the essentials of your parents’ estate plan, no matter its size. “Everyone needs to have a will, power of attorney and a health directive,” says Sanders. Confirm that these key documents exist and find out where they are kept, who else has copies and who is designated as power of attorney or has their health care proxy.

If your parents have named other family members in their estate documents, knowing who they are will let you maintain regular contact and raise red flags if your parents begin to experience trouble managing their money.

If your parents work with financial advisors, lawyers, CPAs or other professionals, ask for their names and contact information. These contacts could become essential if your parents experience sudden or gradual decline.

3. Ease Into Money Management, Too

The more assets your parents own, the more you may need to learn about their portfolios and day-to-day finances.

But no matter how complicated their finances are, go slowly. Start with the basics: how they pay each of their bills (e.g., by check or online) and how they store passwords to their accounts (e.g., a password manager or a notebook in a drawer).

Then—without pushing for hard details like account numbers, balances and passwords—you can ask about their income and what they own and owe in general terms. You might want to start the conversation by discussing:

- Outstanding debts, including mortgages

- Retirement accounts

- Insurance policies

- Pensions and annuities

- Social Security and other income streams (such as rent on a commercial property)

“As with every other step in this process, maintaining trust with your parents will be critical,” says Sanders. “Establish why you need to know the basics before you consider asking for account details.”

4. Remind Them About Elder Fraud

Elder fraud is a serious and growing concern. The FBI reports that over 90,000 victims lost a total of $1.7 billion to various scams targeting seniors in 2021, a 74% increase in losses over the year before. No matter how savvy your parents may be, Sanders notes, it’s essential to touch on this subject. “Tell them, ‘When in doubt, if there are calls, emails or texts about your financial information, don’t respond. Call me, your bank, attorney or another trusted professional first.’”

Additionally, you can share notices and best practices about avoiding scams that target seniors. Forewarned is forearmed.

5. Ask to Meet the Team

If your parents prefer to rely on trusted wealth managers, CPAs, attorneys or other professionals to help manage their money, you should have the names and contact information of each—just as you would for the professionals who handle their estate planning. “It’s smart to tell them, ‘If you’re not comfortable sharing financial information with me, all I ask is that you have a good team. And I need to know who those people are,’” says Sanders. “And ask for an introduction. We always tell our clients, ‘We want to know your kids, too.’”

In the event that your parents are relying on another family member to assist with their finances, make sure you know who it is and ask if your parents would feel comfortable with you discussing their affairs with that person.

6. Communicate and Automate

Especially if you see signs that your parent or family member has stopped exercising sound financial judgment, consider setting up automatic payments on their accounts and arrange to receive copies of their account statements. This will allow you to monitor transactions and ensure that bills are not overlooked.

Even after you assume more control, make sure you remain transparent about all actions you’re taking on your parents’ behalf. Keep clear, updated records of every transaction you facilitate. Save receipts and document all expenditures you make or authorize.

Talk to Your Regions Wealth Advisor About:

- The basics discussing estate and legacy planning with older family members.

- The topics raised in our podcast episode about estate planning for aging parents.

Interested in talking with an advisor but don’t have one?

Find a contact in your area.