A wife relies on her husband to manage their finances, invest their savings and coordinate their estate planning. But when he passes away — sometimes suddenly — she’s left figuring out how to do it all on her own.

But when he passes away — sometimes suddenly — she’s left figuring out how to do it all on her own. “A surviving wife often faces an uphill battle trying to replace income that has been lost due to her husband’s death and take over financial decisions at a time when she is consumed with grief,” says Tracey Armitage, CFA, Vice President and Portfolio Manager for Regions Private Wealth Management. Being unprepared for the possibility of widowhood creates “significant risk to her future financial security,” she adds.

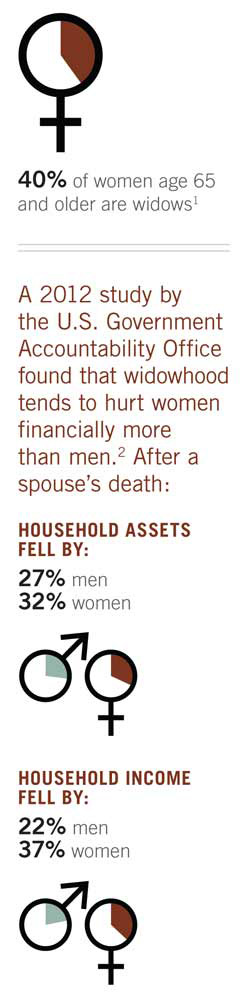

And the probability of widowhood is very real. Women, on average, outlive men their age by about five years, and some marry men several years older than themselves. In fact, about 40 percent of women age 65 and older are widows, according to the Administration on Aging.1 These statistics make it critical for couples to plan ahead and ensure that a wife can assume managing household finances, investments and an estate plan in case her husband predeceases her, Armitage says.

Here Are Four Steps that Can Make the Transition Easier:

Step 1: Learn Investing Basics.

Some widows feel uncomfortable putting assets into anything other than cash instruments such as savings accounts or CDs because they’re unfamiliar with how stock and bond markets work. Both spouses should understand, for instance, how asset allocation reduces risk and can help savings grow beyond the inflation rate so they don’t lose real value over time.

Step 2: Create Detailed Estate Plans And Instructions.

Step 2: Create Detailed Estate Plans And Instructions.

Make sure your estate plan accounts for the possibility of one spouse outliving the other by several years. This includes reviewing employer pension benefits, Social Security, life insurance and the possibility of using trusts to transfer money tax-efficiently. But it’s also about ensuring that a wife can tap the income sources left for her, as well as change beneficiary forms and the will after her husband’s death.

Couples can accomplish this by writing out detailed instructions for a surviving spouse to follow and including key information, such as account numbers and the advisors’ and estate lawyer’s phone numbers. Instructions should also explain how to access online accounts.

Step 3: Get Saving And Investing Experience.

Firsthand experience saving and investing money can help a wife get a better handle on managing her family’s wealth later in life. One option, if she’s not working, is setting up a Spousal IRA, a retirement plan that can allow her to make tax-deductible contributions, choose investments and follow account statements.

Step 4: Regularly Meet Together With Advisors

A useful way to ensure that both spouses are ready to inherit the couple’s wealth and manage it solo is for them to meet together, at least once a year, with their financial and legal advisors. Armitage says this will allow a wife to have input in financial decisions and ask key questions while her husband is living. She can feel comfortable knowing that both her and her husband’s financial needs are addressed, while allowing her to build a trusting relationship with their advisors. “The earlier wives get involved in making decisions, the better off they’ll be,” Armitage adds.

1 “A Profile Of Older Americans: 2011,” Administration On Aging, U.S. Department Of Health And Human Services, 2011.

2 Retirement Security: Women still face challenges,”U.S. Government Accountability Office, July 2012.