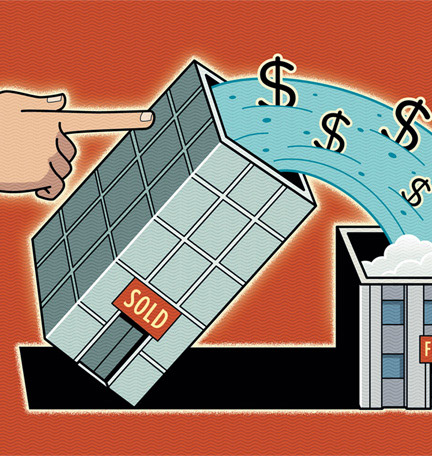

A 1031 exchange is a device that can allow you to postpone capital gains taxes when you adjust your strategy.

For most affluent families and individuals, real estate is a meaningful asset but one that is often not fully integrated into ongoing wealth strategies. “Whether it’s an office building or apartments, a manufacturing facility or a warehouse, investments in real estate can confer tax benefits when integrated into your overall wealth strategy,” says Miller Dowdy, Real Estate Asset Manager for Regions Natural Resources & Real Estate group. “That’s true even if it’s the property or facility that houses or constitutes your business.” Most prominent among these benefits is the ability to defer capital gains through a 1031 exchange.

How it works

If you sell one appreciated property and reinvest those funds in a property worth as much or more than the property you’ve sold, any capital gains from the original sale are realized without taxation. But the clock is ticking: You must complete both transactions within a prescribed timetable, Dowdy says.

Strategies to consider

Using a 1031 exchange can be like a powerful “reset button” for your real estate portfolio. Being able to exchange one property for another opens a world of possibilities. Savvy investors can seek to upgrade the quality of their assets, reduce exposure to risk and tap into promising opportunities. “A 1031 exchange might allow you to shift investing priorities without the burden of paying capital gains taxes,” says Dowdy.

Key best practices

A 1031 exchange may seem straightforward on the surface, but there are complex rules and there are serious consequences if those rules are breached. If the amount of debt you hold decreases when purchasing the replacement property, for example, the person or entity doing the 1031 exchange will incur a capital gains liability on the difference, negating some of the potential benefits.

Talk to your Regions Wealth Advisor about:

- Whether a 1031 exchange may be the right strategy for you.

- Our asset management capabilities.

Interested in talking with an advisor but don’t have one?

Find a contact in your area.