Knowing how lenders see you is a vital part of maintaining financial health.

When considering whether to get a personal loan to buy a car or a home, your first thought may be to check your bank account. But there are other factors that may be just as important: your credit score, along with your credit report.

Together they show how lenders view you, and they will help you understand your ability to take out a mortgage, qualify for a personal loan or obtain a credit card at reasonable interest rates.

Even if you’re not planning to borrow money in the near future, regularly checking your credit score and credit report can help you better understand your total financial situation and begin to plan accordingly. You’ll also be better able to spot any inaccurate or incomplete information that may be part of your credit history, and to identify any fraudulent accounts opened in your name.

Monitor Your Credit Periodically

By law, you are entitled to receive a free copy of your credit report from each of the three major credit reporting agencies—Equifax, Experian and TransUnion—every 12 months. Currently, all three credit bureaus are offering free weekly credit reports until the end of 2023.

The easiest way to request your credit report is to visit annualcreditreport.com. This is a central website for all three major credit rating agencies. When you go to the site, make sure you have your personal information ready. You’ll need to provide your name, address, Social Security number and date of birth. In addition, you may need to provide previous addresses and other information only you would know, such as the amount of your monthly mortgage payment.

You can also contact the three credit bureaus independently and request a copy of your credit report by phone or mail.

Your credit card statement or loan statement may include your credit score, or you may be able to check it via your bank’s or credit card issuer’s website. If not, Equifax, Experian or TransUnion can provide it.

There are also alternative scoring models such as Transunion’s CreditVision New Account Score (CVNA). The CVNA puts more focus on actions reflecting your credit today rather than in the past, which can be helpful to those without a lengthy credit history who want to apply for a credit card, for example. When reviewing your CVNA score, it’s important to remember that your CVNA score may possibly be lower than your FICO 08 score. Having a CVNA score with a lower number than a FICO 08 score doesn’t necessarily mean that either score is inaccurate. It simply reflects the fact that the two scores were generated based on the different variables.

Protect Your Credit From Mistakes

One of the most important things you can do is review your report and credit score regularly to track changes and make sure the information is correct. Errors do occur, which can hurt your credit score.

Credit histories can sometimes include accounts that don't belong to you, employers you didn't work for, and previous addresses where you never lived. If you find any errors, contact either the credit bureau that issued the report or the lender or other person who provided that information to the bureau.

Once you report an error, it will be investigated. If the investigation confirms that there is an error, it will be corrected and you may obtain a free credit report.

Our records show that Regions customers with credit scores under 620 see their scores increase by an average of 49 points in the 12 months after opening a Regions Explore Visa® secured credit card, and an average of 58 points in the 12 months after opening a Deposit Secured Loan.

Three Things to Do

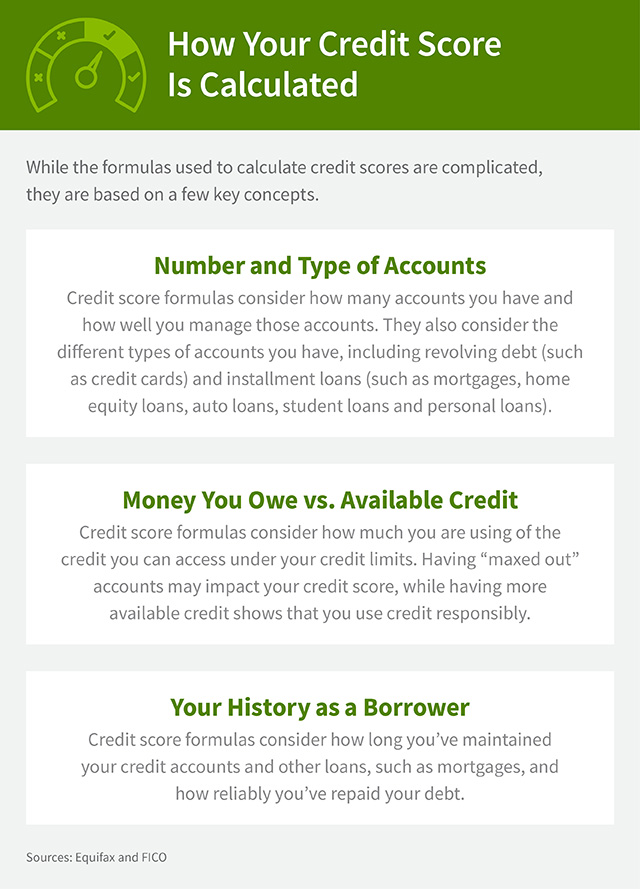

- Read about the factors that play the biggest role in determining your credit score.

- Learn how a secured line of credit can help you build a credit history.

- Listen to a podcast on how to improve your credit score.