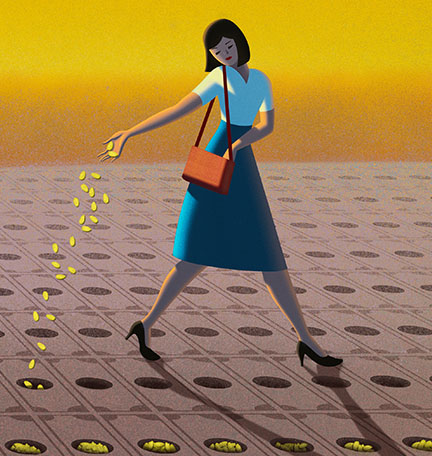

Sloppy record-keeping is one of the most common mistakes committed by business owners. Unfortunately, it’s also one of the most consequential.

When it comes to running your business well, few things can be more problematic than sloppy record-keeping. From missing out on tax deductions to losing your arguments in an IRS audit, disorganized and incomplete records can cost you big-time. These business finance shortcuts will help keep you on track.

The average small or mid-sized business owner is simply bad at record-keeping. Poor record-keeping can cause you to pay more in taxes, misplace a bill, or make a payroll error. It evokes headaches if you have to file an insurance claim or are faced with a lawsuit, and it contributes to daily inefficiencies that ultimately cost time and money. Your best bet for staying on track of your business finances is developing a simple system that takes up as little time as possible.

- Make electronic copies. Paper documents are more likely to get lost or misfiled. Maintaining digital copies of important records, including receipts, is paramount. Remember—if you’re audited, the IRS will want to see receipts to back up your claims. “Record-keeping is usually the difference between having a good or bad outcome if you get under audit with the IRS,” says Andrew Poulos, tax accountant and principal of Poulos Accounting & Consulting, Inc. in Atlanta, Georgia.

Poulos suggests investing in a scanner so you can create and organize electronic copies. “Then, do regular backups of the electronic records to prevent an unforeseen loss of data. Once business owners implement scanning, they quickly realize how much time it saves them and that they don’t have to store paper receipts for years. They understand how easy record-keeping can be,” he says.

- Don’t save everything. You’ve made the commitment to electronic records—now you need a system for determining what you keep. “Large organizations invest in information governance and professional record-keeping because they know the value of being able to find what you need, when you need it. Smaller-sized business owners frequently overlook these practices at their peril,” says Gordon Rapkin, CEO of Archive Systems, a unified document management company based in Fairfield, New Jersey.

Often, small and mid-sized companies adopt what Rapkin refers to as the “shoe-box principle of filing,” where every scrap of paper gets stuffed into a drawer or cabinet. “The guiding principal is: ‘Know what you have, keep only what you must, eliminate what you can, but do so according to a routine process,’” he says.

Avoid the temptation to save or digitize everything. Instead, develop a simple system for determining what needs to be retained. Ask your accountant or financial partner for help if you’re uncertain.

- Delegate or consider a software solution. No one is good at everything. If record-keeping is simply not one of your strengths, delegate the task to an appropriate and organized member of your team, or even consider hiring a new employee or outside service to manage this process.

You can also invest in a software solution that indexes your saved files and can retrieve them quickly when a need arises.