For nonprofits, a strong spending policy is the key to doing short-term good while ensuring long-term viability. Here’s how to create one for your organization.

Key takeaways for nonprofit leaders:

- Assess your revenue, expenses, and endowment planning.

- Know your mission, your goals, and your organization’s differentiators.

- Get buy-in from board members, staff members, and donors.

- Turn to experienced professionals for guidance.

- Structure your endowment for success.

The people who make decisions at nonprofits deal with uncertainty every day, and that’s been especially true over the last two years. As in-person galas and annual events have shifted to online membership drives and virtual events, nonprofit leaders have had to rethink their approach to fundraising while simultaneously taking proactive steps to improve the organization’s financial stability.

So, what can leaders, and the volunteers who partner with them, do to shore up their organizations in times of uncertainty? For many nonprofits, creating a spending policy will be an important first step.

“The best practice is to have a spending policy,” says Marcie Braswell, Philanthropic Solutions Executive for Regions Bank. Based on her work with nonprofits of all sizes, she notes that some organizations have skipped this critical step.

“If you do not have those parameters in place, it becomes all too easy to pull from an endowment when times get tough. With the pandemic, we have seen some nonprofits that do not have a spending policy pull more dollars from their endowment, from their investable assets, their nest egg.”

Meanwhile, Braswell notes that the opposite is true for those that have established a spending policy. “Those that have one are sticking to it. The policy promotes discipline,” she explains.

Designing your nonprofit’s spending policy

Nonprofits and the causes they support are not one-size-fits-all, so neither are their spending policies, Braswell says. Still, they do have common elements to assess.

“They need to look at their different levers: for instance, the revenue they can generate and the different sources of that revenue; their expenses and how variable they are; and then their endowment and what they want to draw from it,” she adds.

Those revenue sources, and their volatility, may be drastically different from nonprofit to nonprofit. Some receive governmental grants or assistance, so they must assess what the policy landscape looks both now and for the future. Others rely on fees for services, such as those offered to members, so they need to be nimble enough to adjust the way they offer services based on performance and shifting trends.

The same variability exists for expenses. For example, a small-staff nonprofit with a highly targeted mission may have a different set of operational needs than a large community foundation serving multiple nonprofits and causes.

Assess your levers

With all this variability in mind, the key is to look at the three levers — revenue, expenses, and endowment planning — together when setting spending policy. No single lever exists in a vacuum, says Brent Wright, Director of Institutional Consulting for Regions Bank.

“The conversation we have around those three levers is how important it is to think about them holistically, and the effect they have on one another,” Wright says. “Spending can be affected by all the other components in both a positive and negative way. It’s one critical component, but one of several that we have conversations with our not-for-profit clients around.”

Consider your long-term vision

In those conversations with nonprofit clients, Wright has seen one highly positive trend: more strategic thinking.

“For the organizations that had a good plan and spending policy [before the pandemic], it has been easier to stick to it,” he says. “Where we’ve seen a change or trend in the past couple of years is in those organizations that haven’t had as much of a corporate structure around them in the past. Either they’re talking about creating an endowment, a nest egg, or they’re formalizing a spending policy, or they’re starting to take a strategic, multiyear mindset for the first time.”

Nonprofits making such a strategic shift face a few challenges, Wright and Braswell say. Often there’s an immediacy to the cause at the core of a nonprofit’s mission. That immediacy may lead to shorter-term thinking, both in terms of revenue generation and spending. Put simply, when solving urgent problems, it’s easy to want to solve them right now.

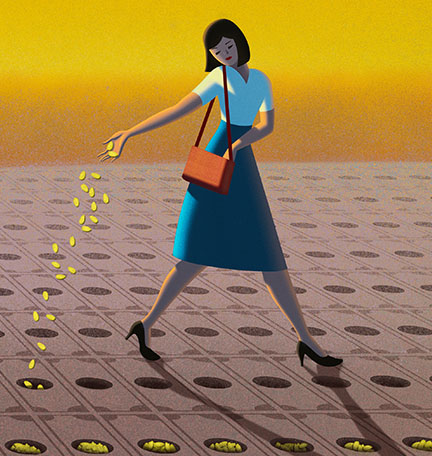

“There’s a definite tension between spending now and putting money aside for long-term viability,” Braswell says. “For most nonprofits, their mission, which is critical today will continue to be vital in the future. So even though there is tension with short-term needs, they are also aware that there will still be needs in the long term.”

A smartly crafted endowment and sensible spending policy can ease that tension. The goal: to maintain an organization’s mission not just now, but for years to come.

Ask the right questions

Setting spending policy is a board-level decision, Braswell says, but it works best in deep collaboration with organizational leadership and staff.

To help inform the process of creating your nonprofit’s spending policy, all stakeholders should collaborate to ask and answer questions regarding your organization’s goals, finances, and guidelines.

Factors to consider when creating a nonprofit spending policy:

- What is your plan for endowment fundraising, and how likely are you to meet those goals?

- What’s the current health of the organization regarding everything from finances to services to staffing?

- For programming and operations, what is your strategic plan? How many years does it cover?

- Do you want to maintain the status quo — serving the same number of individuals, for instance — or do you wish to grow?

- What is your gift acceptance policy? For example, can donors indicate specific gifts for specific programs or causes versus general operating funds? Setting a gift acceptance policy is especially crucial for organizations establishing an endowment for the first time.

- For an endowment, do you want to be able to draw from it right away or set rules that you can only draw from it once it hits a certain threshold?

Seek guidance from experienced professionals

In addition to internal staff, nonprofits can lean on experienced board members with specialized skills in finance, corporate structure, law, and other fields to not only answer these questions but also set parameters for spending. External advisors — particularly those who work with a large nonprofit client base — can serve as everything from sounding boards to research resources to administrators.

Understanding industry best practices is key. This is particularly important when it comes to structuring an endowment fund.

“Your spending policy has to be mindful of the future of the organization, because the goal is to go on in perpetuity,” explains Alan McKnight, Chief Investment Officer at Regions Bank. In his experience, working with an advisor who specializes in nonprofits and understands the nuances can help ensure the long-term success of your plan. “It's something that you really need experience for, and you need an organization that can understand the intricacies,” he notes. “Typically, nonprofits don't have this experience in-house, so to find an external professional that can help advise and counsel is critical.”

In Episode 26 of Regions Wealth Podcast, Chief Investment Officer Alan McKnight touches on essential factors to consider when structuring your nonprofit’s spending policy.

Calculating your spending policy

According to McKnight, your nonprofit spending policy should be aligned with and parallel to an investment program that articulates how much investment return is needed to be able to support your organization's goals.

“The most common calculation that we see for a spending policy is around a rolling average of market value of the endowed assets over the long term,” Wright says. “So the state of an endowment and spending policy go very much hand in hand.”

“That’s where the art and science come together,” he adds. “We can do calculations and forward-looking simulations on what our expectations are for the market, and what the corpus of the endowment might look like, and how we can maintain purchasing power related to inflation and spending policy over time.”

In the past, many nonprofits used income production as the key basis for setting spending policy. That’s less reliable in an era with both lower interest rates and uncertain income production.

“If there has been a clear industry trend around this in the recent past,” Wright says, “it’s that organizations are moving away from the income-based calculation and more to a spending policy based on total return. And our research has shown that [spending based on income production] forces you into some asset allocation decisions, in a quest to produce income, that might not match with a desire to grow over the long term. And so, it really can be a little bit of the tail wagging the dog in terms of the spending driving asset allocation decision as opposed to the other way around.”

Nonprofit spending policy: Key takeaways

Ultimately, for both Wright and Braswell, a few key principles rise to the top. Know your mission, your goals, and your differentiators. Think holistically, since spending is never an isolated conversation. And think long term when it comes to both your endowment planning and your spending policy, since meeting current and future needs are not mutually exclusive.

That last point is critical for conversations with board members, staff members, and donors alike. Nonprofits need buy-in from all of these groups.

“It’s really not an either/or; it’s an and,” Braswell says of short-term giving versus long-term endowment. “It’s a discussion of amplifying and magnifying support of the organization.”

Looking for additional guidance? Learn more about our nonprofits, endowments, and foundations capabilities.